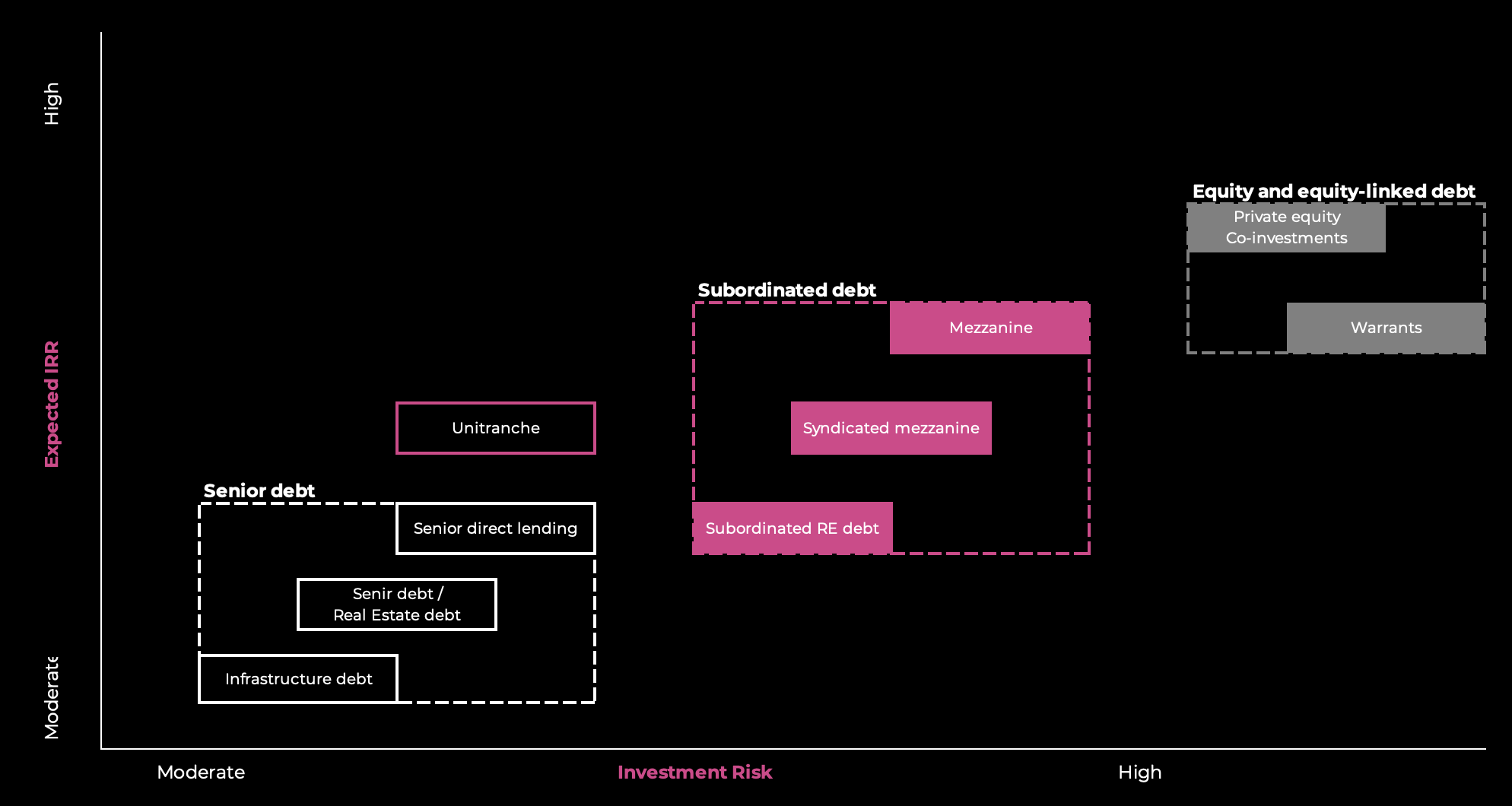

Private debt market offers bespoke solutions for a variety of applications

Below we present a short characteristic of key instruments

Senior debt

May take one of many forms. Typically, companies have a revolving line of credit facility and various tranches of term loans. Their common characteristic is the seniority in terms of repayment order – they are first to be repaid

Subordinated debt (or sub debt)

is any type of debt which would not be repaid until all the senior debt claims are paid in full. Within the sub debt category different priorities (seniority) of repayment may apply. Types of sub debt instruments include high yield bonds, mezzanine (with and without warrants), payment in kind (PIK) notes, and vendor notes – listed from the highest to the lowest priorities, respectively. High yield bonds typically are publicly traded securities allowing for transactions in a secondary market, while Mezzanine finance is not tradable

Senior and subordinated debt refer to the rank in a company’s capital stack. In the event of a liquidation, senior debt is paid out first while subordinated debt is covered afterwards. To compensate an investor for the risk of partial coverage of liabilities the subordinated debt typically has a higher interest rate than senior debt

Mezzanine debt

is a non-tradeable, subordinated security. It often has a bullet repayment (lump sum at maturity), accrued cash return, and can have some equity warrants attached. Equity warrants provide the lender with an exposure to the equity upside on top of the expected return on the interest. Mezzanine debt includes convertible loan stocks, which can be converted entirely into equity, or convertible preferred shares, which can be converted entirely into preferred shares

Unitranche debt

is a hybrid loan structure combining a senior and a subordinated debt into a one debt instrument. The borrower pays a blended interest rate that falls between a senior and sub debt rate

The main goal of unitranche financing is to make life of the borrower easier thanks to a bilateral nature of the relationship with the unitranche provider – resulting for more flexibility and increased access to capital

The main providers of unitranche debt are non-traditional lending entities such as debt funds and institutional lenders which focus on acquisition finance and middle market lending. This form of lending was popular during the financial crisis and the credit crunch that followed (as a solution for troubled companies unable to access loan facilities from the mainstream credit markets). Usually, under the unitranche financing, a single lender provides the entire credit with only a single set of documents